Brady on Manchin-Biden Bill: Attention Wal-Mart Shoppers–More IRS Audits Headed Your Way

The Manchin-Biden version of Build Back Better headed to the Senate floor this weekend, adds $80 billion to the Internal Revenue Service – nearly six times the agency’s current annual budget – to supercharge the IRS and unleash 87,000 new IRS enforcement agents on taxpayers, including the middle class.

“Value shoppers at Walmart and other retailers, already struggling with higher prices and more expensive fuel to drive to the store, will get hit with 710,000 additional audits thanks to the Manchin-Biden Democrat bill”, says Rep. Kevin Brady, the Republican leader of the House Ways & Means Committee. “Every retailer in the U.S. who cares about their hard-hit customers should be fighting to block this unnecessary harassment of hard-working Americans.”

Although IRS Commissioner Charles Rettig has stated the “rate” of audits on middle class taxpayers won’t rise, independent analysis shows the actual number of audits on working class families will skyrocket due to the massive new enforcement force at the IRS. It’s simple – “more cops, more arrests.”

The Democrat tax-and-spend bill contains no language protecting middle-class taxpayers from the new barrage of IRS audits.

What you need to know:

- President Biden has repeatedly tried to mislead the public about his dangerous IRS expansion by claiming that audit rates will not rise for households making less than $400,000 “relevant to recent years.” But the truth is hidden in that phrase.

- A Congressional Budget Office analysis makes clear that under this plan, audit rates will “rise for all taxpayers” and the policy “would return audit rates to the levels of about 10 years ago.”

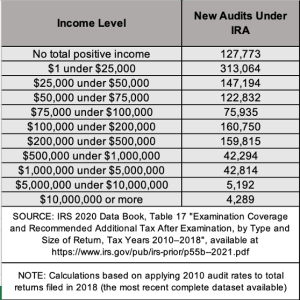

- A simple, conservative analysis applying 2010 audit rates to recent tax filing data demonstrates that the policy will result in 1.2 million new audits per year with over 710,000 of those new audits falling on taxpayers making $75,000 or less. The breakdown of new audits based on income groups is below:

The plan for a supercharged IRS is designed to squeeze as much money out of the American people as possible. And the vast majority of the impact will be felt by Americans making far less than $400,000 a year.

If this bill passes, one of the new 87,000 IRS employees just may be knocking on your door very soon.