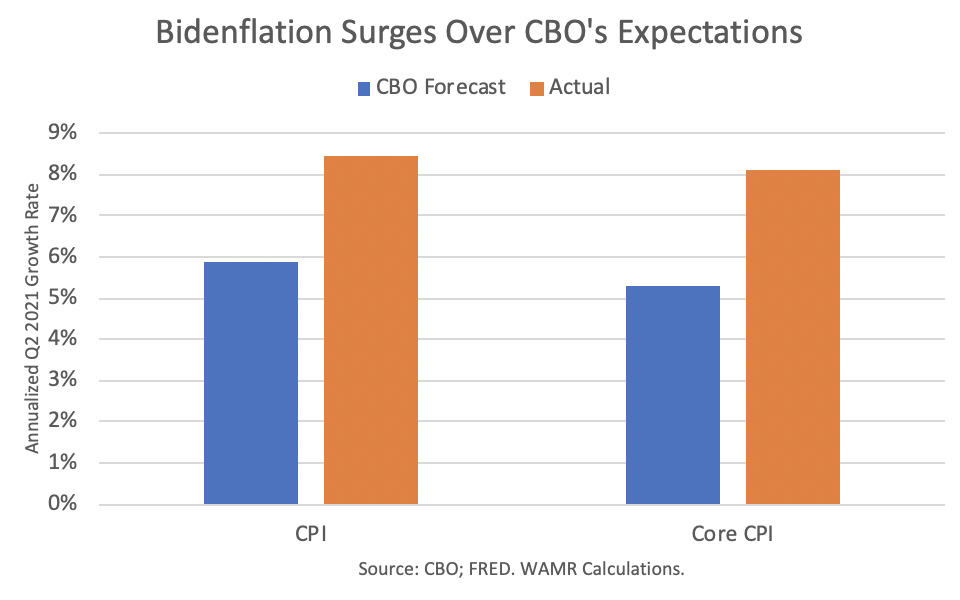

CBO Shows Bidenflation Surges Over Forecasts as Experts Sound Alarms

Economic experts are catching up with what cash-strapped families have known for months: Bidenflation isn’t as transitory as the White House claims.

In fact, the inflation in June skyrocketed past the Congressional Budget Office’s expectations by nearly 3 percentage points.

Here’s what some experts are saying:

“I think most factors point to more cause for concern now than in 1966 when inflation accelerated 3-4 pts in 4 years. Then, the deficit was in range of 3 percent. Now the deficit is in the range of 15 percent. …

“Then, there was no saving overhang, no housing price boom and no major asset price inflation. Now, all three are present to an almost unprecedented degree.

“Then, because of the labor force and productivity growth, supply potential was growing at 3.5 percent. Now it’s less than 2…

“Then the argument was that measured inflation would not accelerate too much from 2 percent. Now it is that inflation will substantially decelerate from 5 percent.”

Axios: Inflation That Can’t Be Ignored

“The White House was counting on fleeting inflation. Now, it’s starting to look like it could last.

“Many of the biggest gains were for goods and services we need as we go back into the world: Plane tickets, hotels, restaurants and cars all jumped.”

Fox Business: Fed ‘binge’ created inflation ‘whirlwind’: Steve Forbes

“Steve Forbes, the chairman an editor-in-chief of Forbes Media, argued that the Federal Reserve’s policies have led to long-lasting inflation and more government spending will only make it worse on FOX Business’ ‘Varney & Co.’

‘Inflation’s here for a while. We’re getting the whirlwind of what was done last year and the year before.

‘Even before COVID, the Fed was printing too much money. They went on a binge last year, perhaps for understandable reasons, but they overdid it.’”

NYT: Inflation jumped 5.4% in June, the biggest rise since 2008

“Policymakers expect inflation will fade as the economy gets through a volatile pandemic reopening period, but how quickly that will happen is unclear.

“Prices have climbed faster than officials at the Fed had predicted earlier this year, certain measures of consumer inflation expectations have risen — something that could make inflation a self-fulfilling prophecy if it becomes more extreme — and some officials at the central bank are increasingly wary.”

WSJ: Inflation Accelerates Again in June as Economic Recovery Continues

“Many economists now expect higher inflation to stick around while slowly easing. Those surveyed by the Journal in July estimate on average that annual inflation, measured by the CPI, will ease to 4.1% in December.”