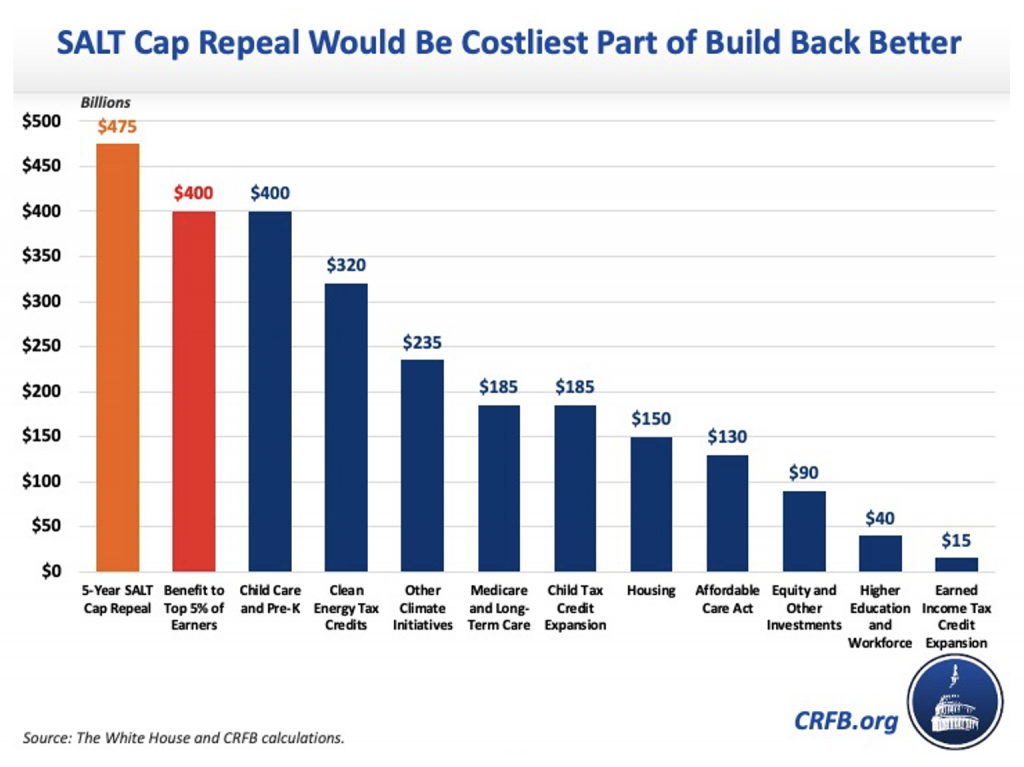

Dems: Hike Taxes on Middle Class to Pay for $475B SALT Tax Shelter for Rich

Lower income and Middle Class American families and small businesses will be facing higher taxes in order to pay for a handout to the rich, the costliest part of Democrats’ tax hikes and spending reconciliation bill.

This handout will cost taxpayers potentially up to $475 billion, with the majority of the benefits only going to the top 5 percent of households, according to an analysis by the left-leaning Committee for a Responsible Federal Budget (CRFB).

As CRFB writes:

“This is an obvious shell game; paying for repeal of SALT cap by extending that very SALT cap does not pass the credibility test… Claims that SALT cap repeal would not add to the debt are highly misleading and not grounded in reality. As we’ve said before, repealing the SALT cap in Build Back Better would be a costly mistake.”

CRFB is one of a number of critics of Democrats’ SALT tax break for the wealthy.

Former Obama-Biden White House economic advisor Jason Furman tweeted:

I hope Congress doesn’t add full SALT repeal to the Biden plan. With it this is the total tax cut for a couple making $9.9m:

California $472,000

Hawaii $398,000

NJ $381,000

Oregon $361,000

Minnesota $357,000

DC $325,000

Vermont $317,000

Iowa $312,000

NY: $306,000

Arizona $285,000

And there’s more:

- The left-leaning Tax Policy Center has criticized the SALT tax deduction as only helping “high-income households.”

- Sen. Bernie Sanders (D-VT) opposed efforts to restore the SALT tax shelter for the wealthy, saying it “sends a terrible message,” and that “you can’t be on the side of the wealthy and powerful if you’re going to really fight for working families.”

- Dorothy Brown, law professor at Emory University, testified before the Senate Finance Committee that repealing the $10,000 cap on SALT deductions would benefit wealthy households the most and widen income inequality.

- The liberal Institute of Taxation on Economic Policy (ITEP) estimates that 85 percent of the tax cuts from the repeal of the SALT cap would go to the richest 5 percent of taxpayers, mostly in high-tax states like New York and California.

Megan McArdle of the Washington Post sums up the case:

- “It would be unseemly to argue that we lucky few deserve a special tax break for making a lot of money and spending it on things we value. Sadly, that clearly won’t stop Democrats from trying…”

- “… According to Maya MacGuineas of the Committee for a Responsible Federal Budget, households in the top 0.1 percent of earners would receive an average benefit of about $150,000, while those in the middle would get closer to $15.”

- “You can probably think of many better uses of taxpayer money than giving a tax break to the most affluent people in the most affluent parts of the most affluent states in the country.”