Eliminating the SALT Cap to Help the Rich Doesn’t Fight Coronavirus

In a time where jobless claims are reaching historic highs and the world is fighting to stop a global pandemic, House Democrats are seeking to cut taxes for the rich by repealing the cap on the SALT deduction.

Prior to tax reform, the wealthy could deduct taxes, subject to limitations, they paid to state and local governments from what they owed to the federal government. Republican reforms capped those deductions to ensure everyone paid their fair share.

As the New York Times reports, “A full rollback of the limit on the state and local tax deduction, or SALT, would provide a quick cash infusion in the form of increased tax rebates to an estimated 13 million American households — nearly all of which earn at least $100,000 a year.”

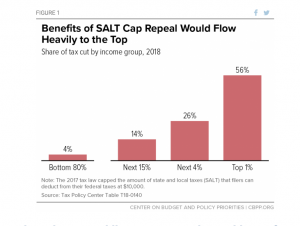

The liberal Tax Policy Center found that that a repeal of the SALT cap would be “regressive and costly.” They concede that “few middle-income households would benefit.”

Over half the benefits of the repeal would go to the top 1 percent of households.

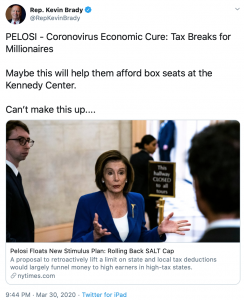

As Ways and Means Republican Leader Kevin Brady said, “Maybe this will help them afford box seats at the Kennedy Center. Can’t make this up.”

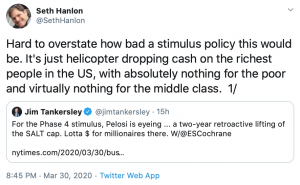

Even Obama’s former economists say it is “hard to overstate how bad a stimulus policy this would be.”

“You often hear people say that it’s different in states like [New York, New Jersey, and California], where the SALT deduction is for the middle class,” said Mr. Hanlon. “But that’s just not the case. It’s overwhelmingly for rich people everywhere.”

Republicans want to help the middle class and Main Street businesses weather this storm so America’s economy can rebound strongly after we defeat the novel coronavirus. Cutting taxes for the rich by repealing the SALT cap has nothing to do with healing America.

Want to read more on the fight against Coronavirus? Read our Coronavirus Bulletin here which contains our extensive FAQ about recent federal actions.