ICYMI- NTUF: Tallying Elizabeth Warren’s Tax Increases

National Taxpayers Union Foundation

Tallying Elizabeth Warren’s Tax Increases

By Nicole Kaeding

November 6, 2019

CLICK HERE to read the full report.

The policy challenges facing the country are immense. Economic growth hasn’t reached its full potential, individuals and businesses pay too much for health care, and red tape holds back innovation and entrepreneurship, among many other concerns. But presidential candidate Senator Elizabeth Warren (D-MA) has a plan for all of them: Raise taxes.

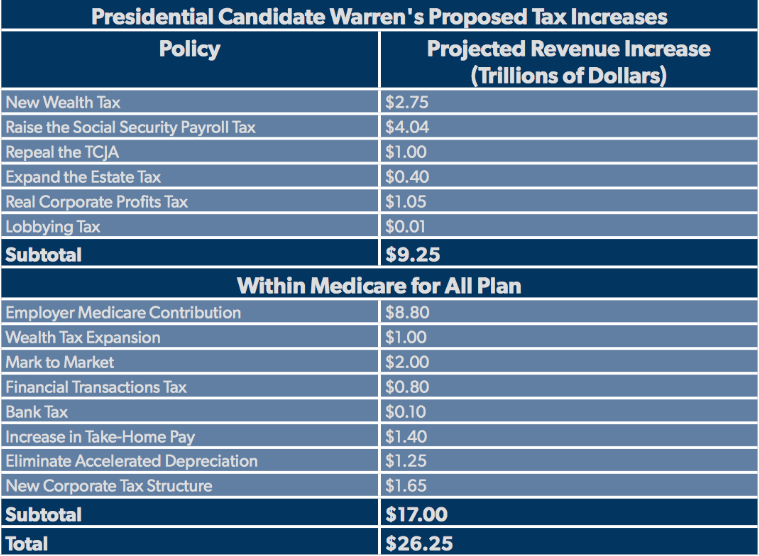

In total, Senator Warren is proposing raising federal taxes by $26.3 trillion over a decade to finance enormous expansions of federal benefits, such as Medicare for All, student loan forgiveness, and universal child care.[1]

. . .

Senator Warren’s Proposed Tax Increases

Senator Warren’s policy proposals include a wide variety of tax increases. These tax hikes hit families, businesses, and estates. Contrary to her claims, many of these plans would, in fact, raise taxes on the middle-class.

- Create a New Wealth Tax:One of Senator Warren’s signature tax proposals is her support for creating a new wealth tax in the United States. It would assess a tax on net assets above $50 million at a rate of 2 percent, with the rate increasing to 3 percent for those with more than $1 billion in wealth. Estimated revenue according to the Warren campaign: $2.75 trillion over a decade.

- Raise the Social Security Payroll Tax: Senator Warren proposes a dramatic expansion of the Social Security payroll tax. Currently, the levy only applies to the first $132,900 of an individual’s wage income at a rate of 12.4 percent. She would assess a 14.8 percent tax on all wages and net investment income above $250,000 for single filers and $400,000 for married couples.[2]Estimated revenue according to the Warren campaign:$4.04 trillion over a decade.[3]

- Repeal the Tax Cuts and Jobs Act: (TCJA) If elected, Senator Warren says that she would repeal an unspecified portion of the 2017 TCJA that benefited the “wealthiest individuals and giant corporations.” Estimated revenue according to the Warren campaign: $1 trillion over a decade.[4]

- Expand the Estate Tax: Senator Warren proposes lowering the current estate tax exemption from $22 million for a married couple to $7 million.[5]She also proposes raising the tax rate from 40 percent to a progressive schedule with rates ranging between 55 and 70 percent. Estimated revenue according to the Warren campaign: $400 billion over a decade.[6]

- Real Corporate Profits Tax: This new tax would assess a 7 percent surtax on corporations with more than $100 million in global net profits, based on their book income. Estimated revenue according to the Warren campaign: $1 trillion over a decade.[7]

- Lobbying Tax: Senator Warren, if elected, proposes to create a new tax on companies that spend more than $500,000 a year on lobbying, with a maximum tax rate of 75 percent. Estimated revenue according to the Warren campaign: $10 billion over a decade.[8]

Senator Warren’s Medicare for All plan included a number of additional tax increases, which are discussed below.

- Employer Medicare Contribution: Senator Warren would convert current employer health insurance contributions into a quasi-payroll tax, charging companies a flat amount based on the number of employees they have and the amount they spent on previous employee health insurance contributions. Estimated revenue according to the Warren campaign: $8.8 trillion over a decade.[9]

- Wealth Tax Expansion:Within several short months, Senator Warren is already proposing expanding her wealth tax proposal. To help fund Medicare for All, she would raise the wealth tax on billionaires from 3 percent to 6 percent annually. Estimated revenue according to the Warren campaign: $1 trillion over a decade.

- Mark-to-Market:Currently, the United States taxes capital gains when the asset is sold and the gain is realized. Under her Medicare for All proposal, Senator Warren would require individuals to pay taxes annually as the asset appreciates, a so-called “mark-to-market” tax system. Estimated revenue according to the Warren campaign: $2 trillion over a decade.[10]

- Financial Transactions Tax:Senator Warren’s campaign says that she would assess a 0.1 percent tax on each sale of stocks, bonds, and derivatives in the United States. Estimated revenue according to the Warren campaign: $800 billion over a decade.[11]

- Bank Tax:Her financing plan includes a new tax on banks “that encourages them to take on fewer liabilities and reduce the risk they pose to the financial system.”[12]Estimated revenue according to the Warren campaign:$100 billion over a decade.[13]

- Increase in Take-Home Pay:Because employees would no longer need to contribute to their health insurance premiums, their pre-tax deductions from their paycheck will shrink. This would lead to more of their wages being subject to taxation, raising federal revenues. Estimated revenue according to the Warren campaign: $1.4 trillion over a decade.[14]

- Eliminate Accelerated Depreciation:This change would modify how businesses deduct their capital investments from their tax returns, increasing the cost of buying new machines and equipment. Estimated revenue according to the Warren campaign: $1.25 trillion over a decade.[15]

- New Corporate Tax Structure:Senator Warren would raise the corporate income tax rate from 21 percent to 35 percent and dramatically expand taxation of a company’s foreign profits. Estimated revenue according to the Warren campaign: $1.65 trillion over a decade.[16]

All told, these tax increases would raise $26.3 trillion in new revenue for the federal government over a decade. This puts Warren’s tax plan decidedly to the left of fellow presidential candidate and Senator Bernie Sanders (I-VT), whose proposals would hike taxes by “only” $23 trillion.[17]

. . .