Trump Tax Cuts Results: Full Review

The Tax Cuts and Jobs Act, championed by President Trump and congressional Republicans, spurred a boom in economic growth that took Americans off the sidelines and got them back to work. Thanks to these reforms, our economy doesn’t have to strain under a tax code from 1986, but will recover with a modern, dynamic tax code that promotes growth.

To download this factsheet as a PDF, CLICK HERE.

MORE JOBS AND INVESTMENT

What TCJA Did:

- Created a historic tax cut for Main Street businesses.

- Lowered tax rates for job creators of all sizes.

- Made it easier for companies to bring jobs and investments back to the U.S.

How the Economy Responded:

- Main Street Optimism Reached An All-Time High. In the third quarter of 2018, small businesses recorded their highest level of optimism to date.

- Opportunities For All Americans Flourished. The unemployment rate reached a generational low, with record low unemployment for women, people of color, and workers without high school degrees.

- Jobs Added to the Economy. Since the enactment of TCJA, the economy gained nearly 5 million jobs before the pandemic.

- TCJA Brought a Record Amount of Job Openings. Under TCJA, job openings were at a record high of 7.5 million jobs.

- Businesses Started to Reinvest Again. Core investments in equipment and other business necessities reversed its Obama-era five-year downward trend and shot back up to near historic highs making businesses and workers more productive, while boosting workers’ wages.

- Business Applications At Record Levels. TCJA encouraged business creation as the amount of business applications reached its highest level ever of over 880,000.

FAIRER TAXES

What TCJA Did:

- Simplified that tax filing process for millions of workers.

- Eliminated the Alternative Minimum Tax for most taxpayers.

- Expanded popular savings tools, like 529 accounts.

How the Economy Responded:

- Millions of Hours Saved. Nearly nine out of 10 Americans took the standard deduction in 2019, no longer needing to go through the complicated process of itemizing.

- Revenues Soared. Breaking dire predictions from experts, federal revenues reached an all-time high, due to more Americans working, bigger paychecks, and businesses expanding.

BIGGER PAYCHECKS

What TCJA Did:

- Cut income tax rates across the board.

- Nearly doubled the standard deduction.

- Doubled the Child Tax Credit.

How the Economy Responded:

- Workers’ networth soared. Low- and middle-class families saw the largest gains in wealth growth in 2018 and 2019, according to the Federal Reserve. Low-income families saw their net worth increase 37%. Middle-class families saw their net worth increase 40%.

- Household Income Reached New Highs. Real median U.S. household income in 2019 rose nearly 50% more than during the eight years of Barack Obama’s Presidency. Median household incomes increased 7.1% for Hispanics, 7.9% for Blacks,10.6% for Asian Americans and 8.5% for foreign-born workers.

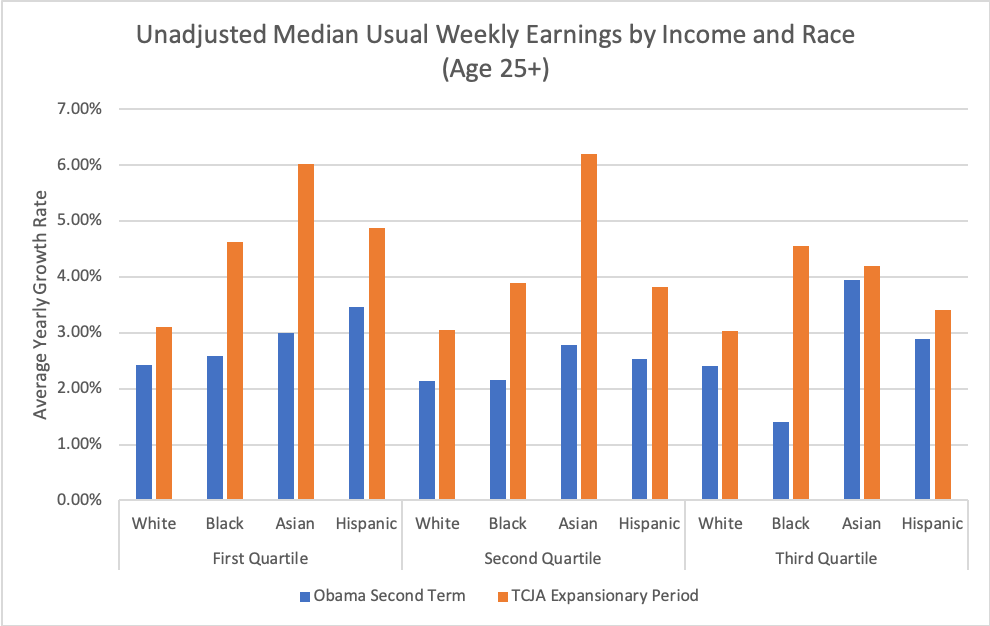

- Wages for Minorities Grew at a Faster Pace. Compared to Obama’s second term, wage growth, as a measure of median usual weekly earnings, grew 24% faster for Hispanics, 79% faster for Blacks, and 95% faster for Asian Americans.

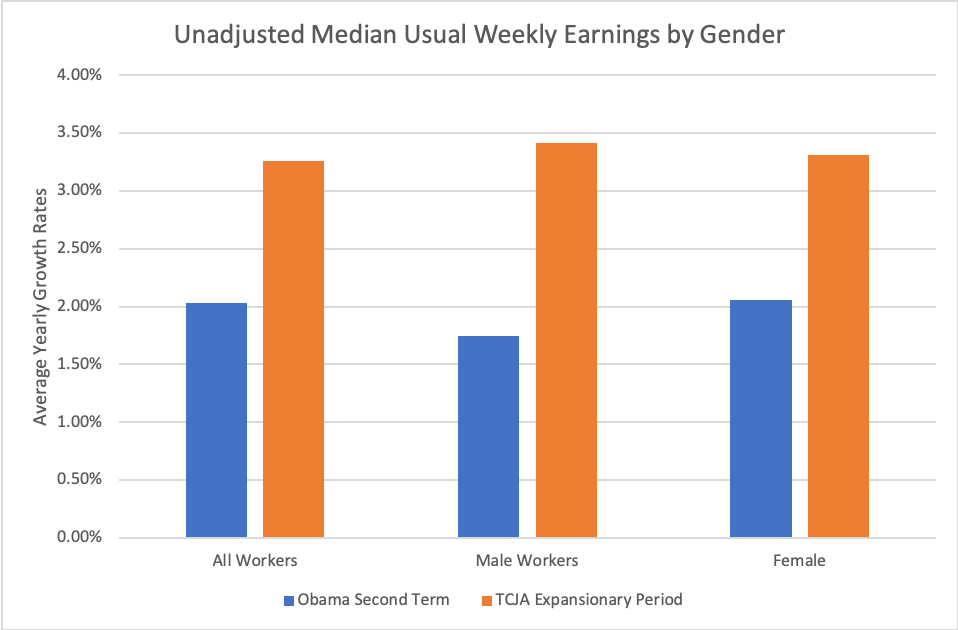

- Wages for Women Grew at a Faster Pace. Compared to Obama’s second term, wage growth, as a measure of median usual weekly earnings, grew 60% faster for women.

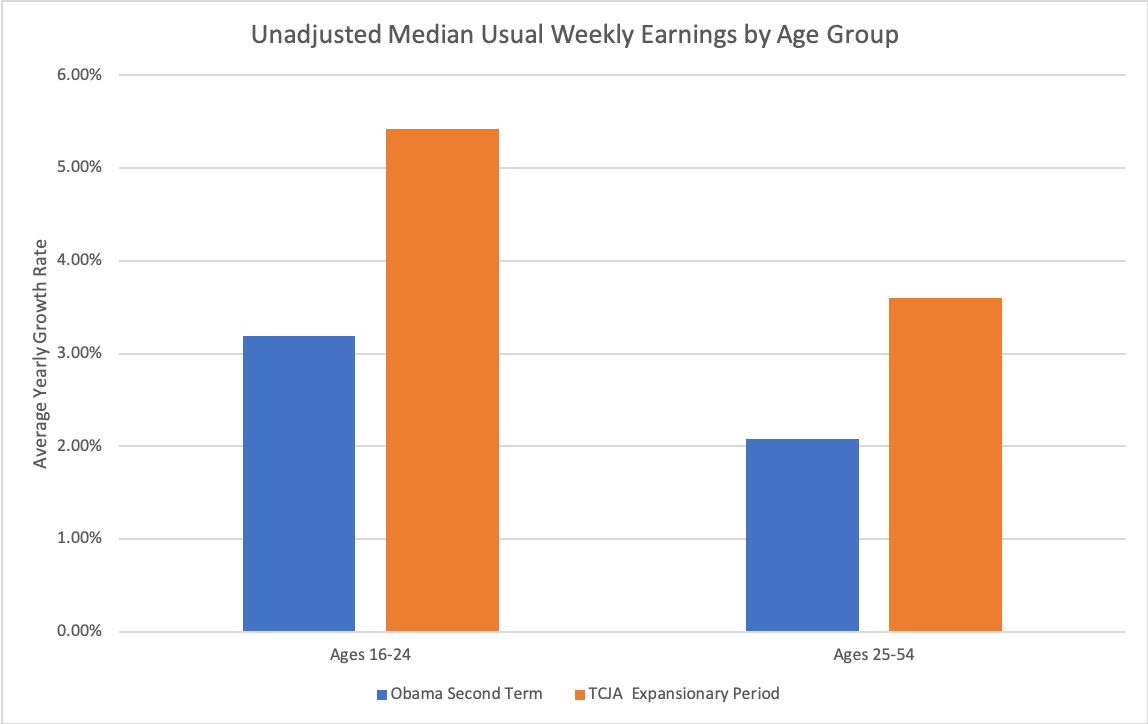

- Wages for Youths (Ages 16-24) Grew at a Faster Pace. Compared to Obama’s second term, wage growth, as a measure of median usual weekly earnings, grew 70% faster for women.

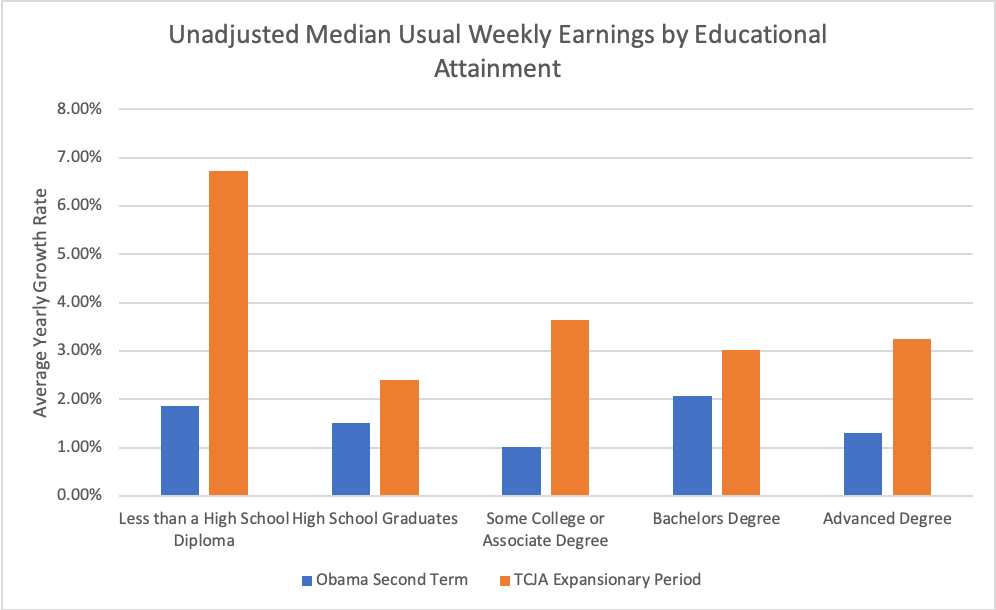

- Wages for All Levels of Educational Attainment Grew at a Faster Pace. Compared to Obama’s second term, wage growth, as a measure of median usual weekly earnings, more than doubled for those with less than a high school diploma and those with either some college or have an associate degree.

Want to read more on the fight against Coronavirus? Read our Coronavirus Bulletin here which contains our extensive FAQ about recent federal actions.

Was this message forwarded to you? CLICK HERE to subscribe to our emails.